Case Study, UX/UI, Business

Empowering Debtors with Tech: Unveiling the Cerebreon Mobile App Story

Client: Cerebreon

Industry: Financial Technology

Services: Discovery & Strategy Workshop, Market Research, Prototype, Mobile App Design

👉 Introduction

Have you ever wondered how to make life easier for debtors? We have. And it seems that in cooperation with our client, we succeeded - we have launched the Cerebreon mobile application on the market. It allows not only for a preliminary review and analysis of what debt repayment plan the “British King offers”, but also monitoring of what stage of repayment you are at. And it lets you know how well you are doing (or not so well…) and what happened that your debt increased or decreased.

Below is the story of how we merged business growth with genuine user aid, transcending competition by not only focusing on 'what pays off' but also on 'how we can ease the burden of those already suffering.’ It's a tale of support and optimization on a difficult path. Not easing debtors’ life's burdens or paying off their debts, but reducing stress and anxiety, offering clarity and actionable insights on their financial standing and necessary steps. Supporting their agents and agencies by unburdening their lines and reducing call volumes, while adding new service to their offerings.

👩🔬 How it all started?

In the early spring of 2021, Kenneth from Cerebreon ventured into our forest, seeking a partner to navigate the uncharted terrain of mobile debt management solutions. Together, we embarked on a quest to extend their reach from the web to mobile, focusing keenly on the needs of those treading the debt trail.

On a daily basis, Kenneth (CTO, COO), Gillian (CEO), and the entire Cerebreon team create software in Ireland that supports British companies serving those in debt. Until then, they focused on a web application, but they noticed a significant need to expand their offerings to include a mobile solution that focuses even more on the debtors themselves, not just the agents who service them.

"Our mission is to support the most vulnerable people in society to help them to avoid insolvency. Unsecured personal debt was measured at £3.6 billion, [and] with the Covid-19 outbreak UK families are taking on increasing levels of debt to survive,"

said founder and chief executive Gillian Doyle, for the Irish Times interview

He came to us with a long list of business ideas and needs - definitely too long for our liking - meaning, we would have been delivering such a scope for ages, and before they would see the effect, the needs would have changed... More on that topic in a moment 😅

🌲 The journey

Our expedition began with gathering wisdom through research and workshops, akin to charting a map for this new terrain. Each session was a step deeper into the domain's thicket, helping us to carve out a clear path for the product's journey.

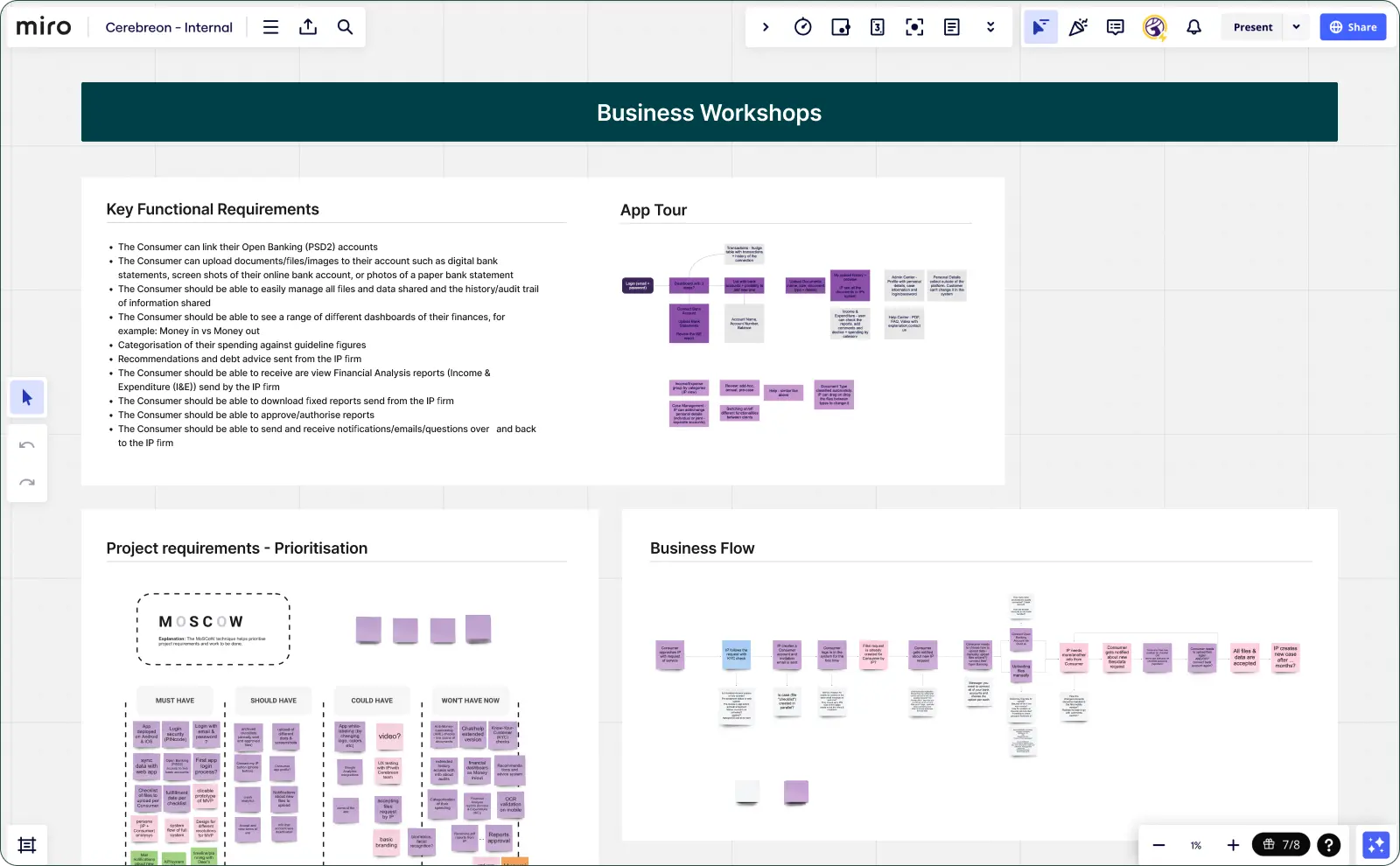

Already at this stage, a big challenge was the domain itself - the personal insolvency and bankruptcy industry in the United Kingdom. It was necessary not only to familiarize ourselves with the specialist terminology in a foreign language but also to understand the social and legal system and the client's business. We did solid desk research, but also simply talked with Kenneth. Not just like that, but also as part of a series of workshops. We used Miro at the time and then it served as a knowledge base for the whole project and meetings - shared between the Purple Deer and Cerebreon teams.

We tried on the one hand to listen a lot and take notes, but also to organize and question certain gaps or inconsistencies. Part of the workshops was also a tour of the current solution - the Cerebreon web application.

Let’s go back to that long list of priorities. We wanted to fit in the timeline and deliver something that would give business value. And that’s when we’ve used the first trick - very much liked by the Deer - let’s list and prioritise. Strategy before action.

We’ve used here a tried and true MOSCoW technique. Together - we mean designers, developers, the client’s team, and our Product Owner - we have run a session where we’ve listed all the bits from UX/UI, technical, and business perspectives. And sorted those as Must, Should, Would, and Could.

Sounds so simple, yet it’s a very eye-opening and clearing-the-picture exercise. What’s also important is to share different perspectives - not run separate sessions for different departments. Those plans and visions might not be realistic that way and to make them so you would need to re-run some of those after having feedback from the other.

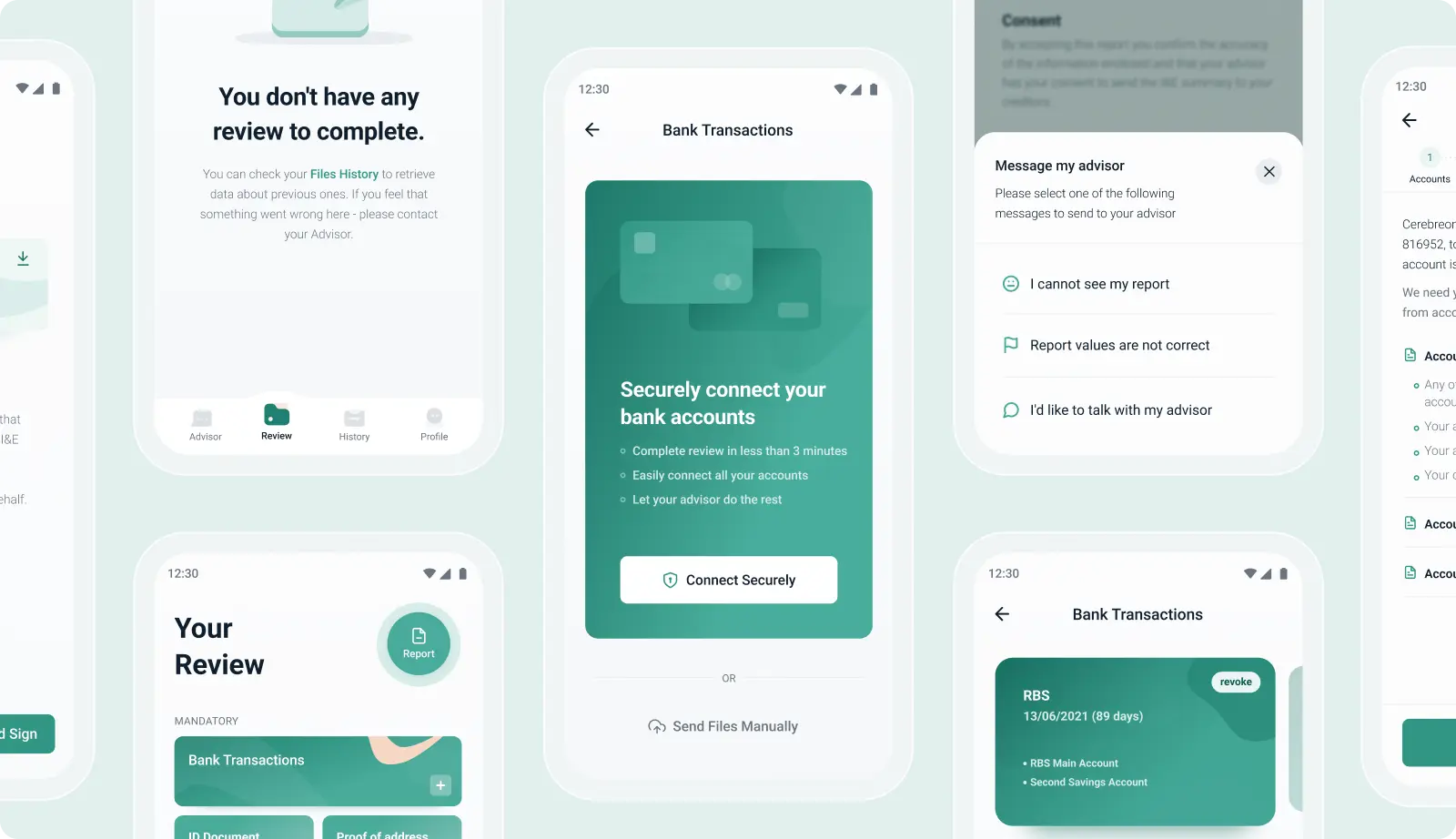

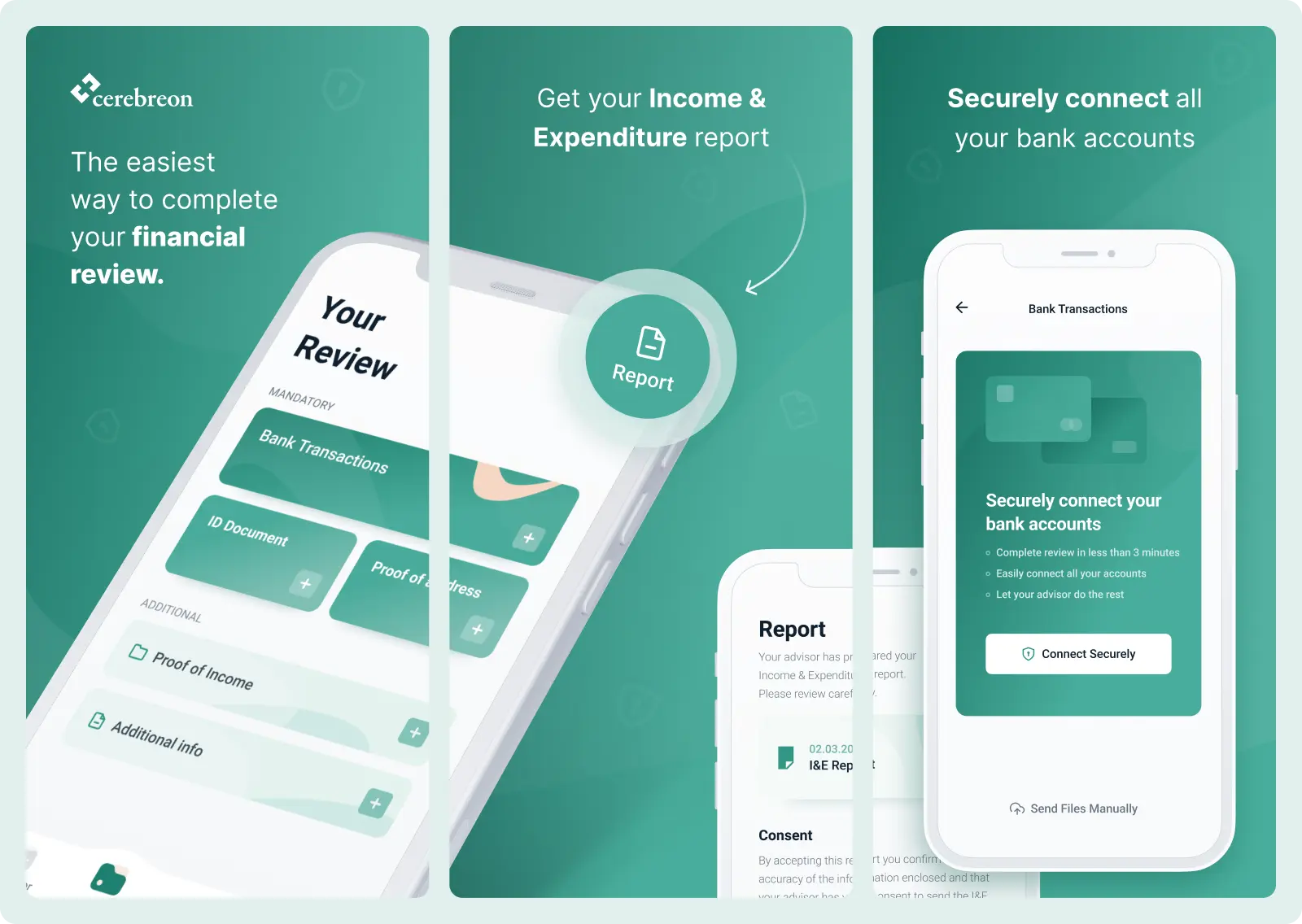

We defined the goal for the first stage - manual uploading of documents as part of the debtor's review and granting direct access to the debtor's bank account so that the system could retrieve the necessary data on his behalf and analyze them. So-called Open banking - not bad! Sounds space-age and interesting from a developer's perspective, but how do you convince someone who is in financial trouble to let anyone review data from their bank account? Oh, another "tiny challenge".

“Their dedication and ability to understand our industry and our end users profile was great right from the start. This enable them to provide beautiful UI and UX designs.”

~Kenneth

📊 How to make sure it will work if you don’t know the user directly?

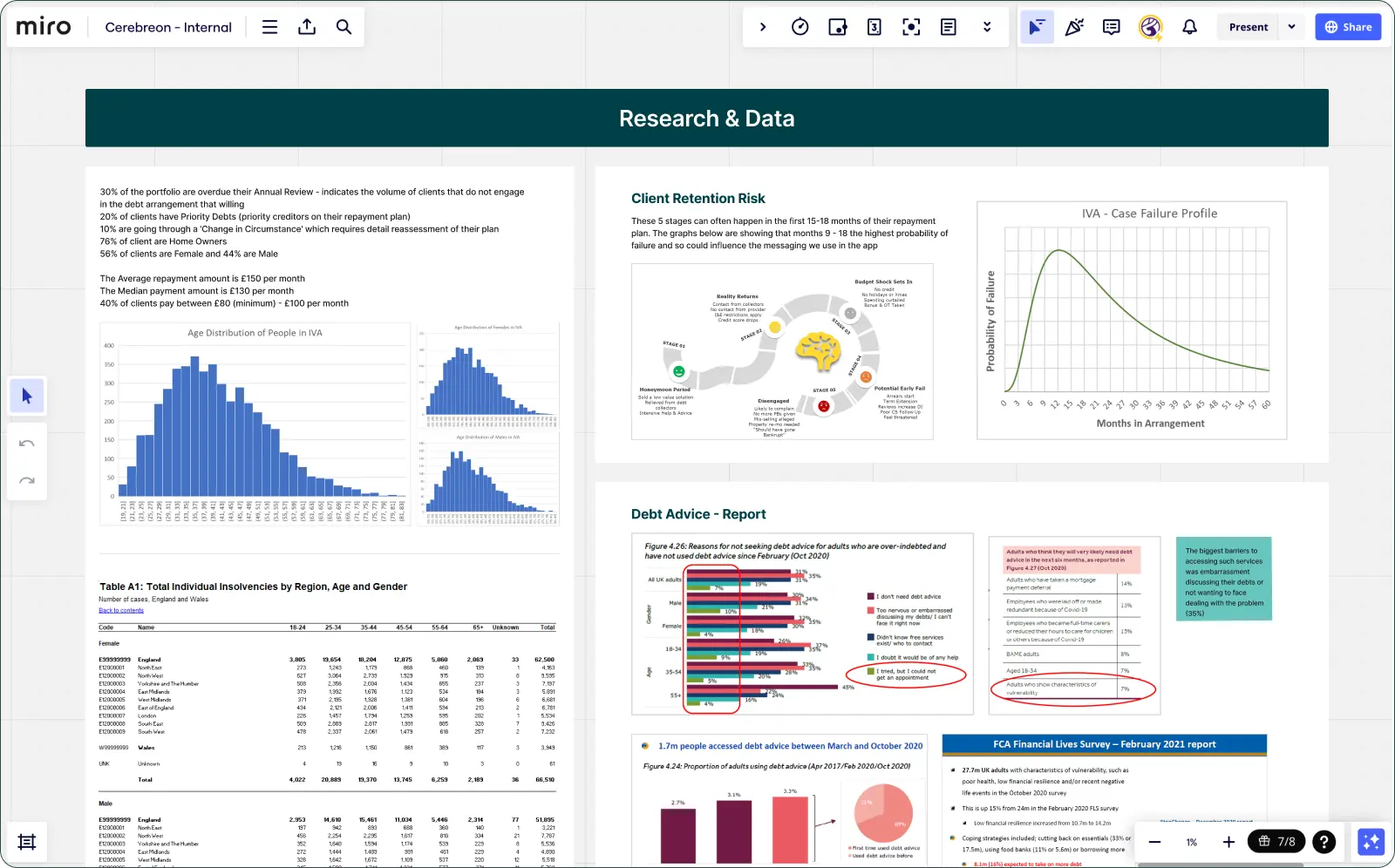

One of the bigger challenges was preparing the application for the target group, which is those in debt. Unfortunately, we did not have access to the debtors themselves - they are not the direct clients of Cerebreon and for various reasons, including the nature of the subject (quite delicate), we were unable to talk to them directly. Cerebreon direct/paying customers are the Debt Advisors and Insolvency Practitioners firms who help and represent an individual in money trouble (the Consumer). The Consumer was our user and main “attention target” when thinking about the mobile application.

So what we did do to not venture blindfolded?

Facing the challenge of not directly accessing our end-users, we turned to in-depth market research and agent insights, allowing us to build a product that truly addresses debtor needs.

We were able to ask a lot of questions through agents who talk to the Consumers and support them daily. Via Kenneth, we’ve suggested some questions and received answers. Another bit was to conduct quite extensive research on online groups and forums where people are discussing their debt problems. It was a real gold mine and allowed us to empathise and understand the case even though we didn’t know much at the start. And - last but not least - the whole Cerebreon team knows a lot about their users - we would say that’s because they do genuinely care about them - and so we were able to understand a lot just by discussions with them.

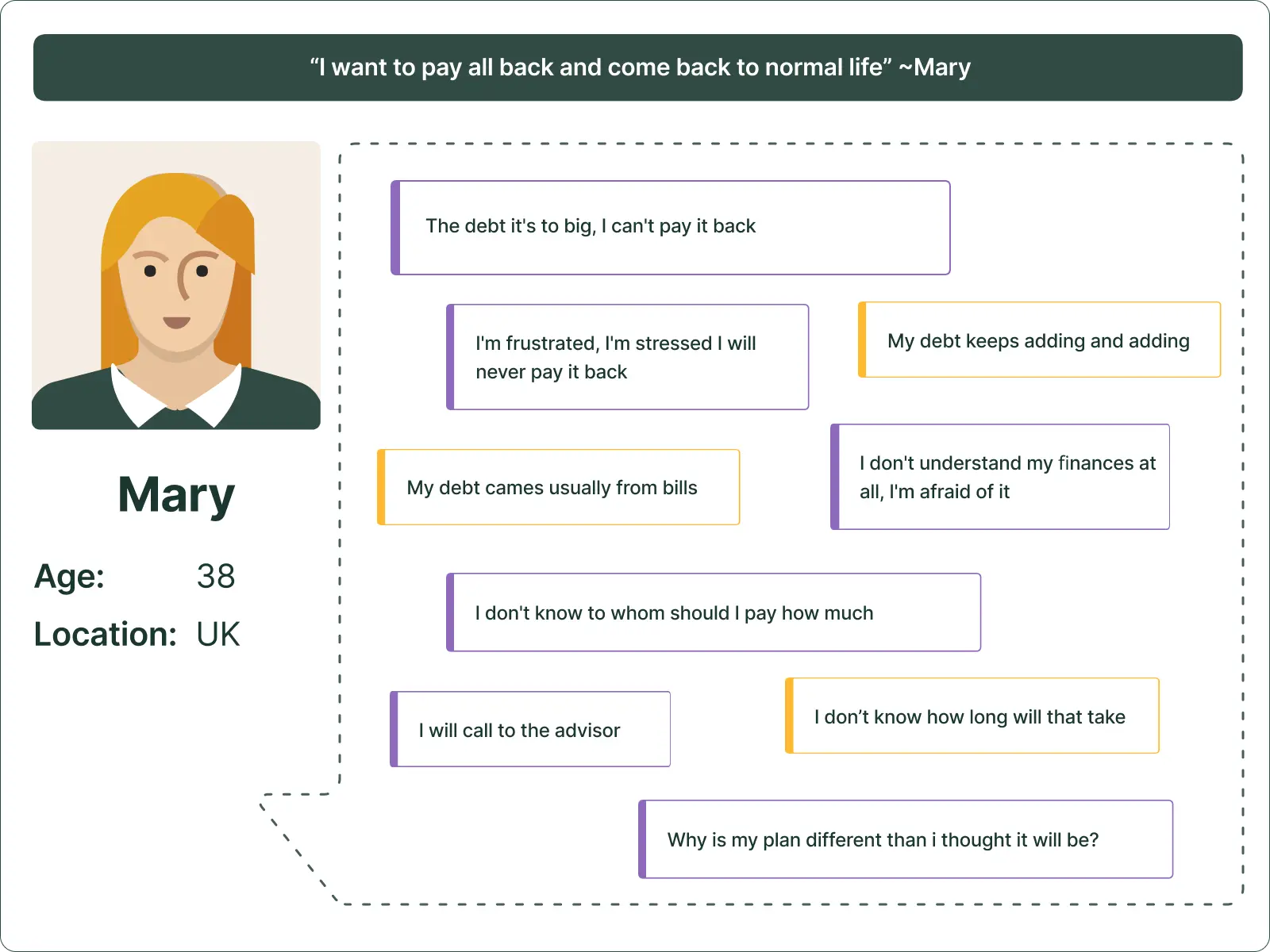

As part of the workshop sessions we also prepared empathy maps and proto-personas. You may like that or not - we know that’s a lot of discussion if they give any value. In this case - and used wisely - they did. They were a starting point of the discussion on what’s an assumption and what’s a fact. Then, they’ve allowed us all (again, we mean here technical, design, and business representatives in the team) to focus on users and business goals clearly defined, not only on the technical flow or possibilities.

And what findings do we get after those steps?

We have understood how many different repayment plans could exist in real life - that several family members could need access to the same debt plan, and what data might each of them search for.

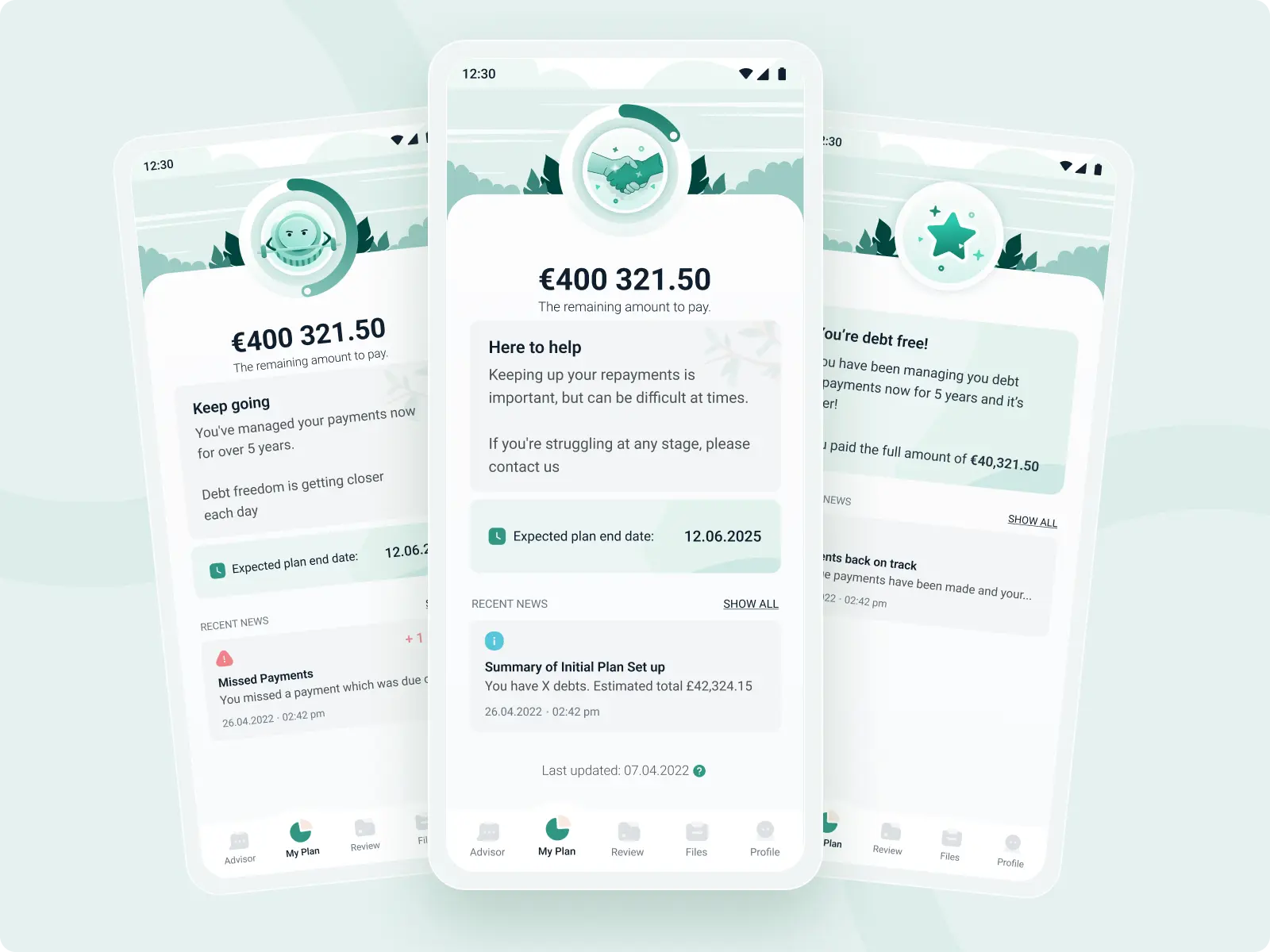

Other competitors on the market didn’t have yet the option to show how much is still to be paid off. It was surprising as when you think about paying off the debt it’s so basic to know. Yet, it wasn’t there. And could be used as a competitive advantage for Cerebreon.

Based on the research with the agents we knew that the most frequent questions that they have been asked were “How much is still to be paid off?” and “How long the whole (repayment) journey will last? When I’ll be free?”. Another bit, which was quite risky, was how to enable as many details about debt as possible for the Consumers, while not making them confused and not increasing the amount of calls to agents after releasing the upgraded app.

🙆♀️ The struggle

What was the tough fact? We all knew that on the one hand, the debtor would have to use the application, but on the other - it depended on us what feelings would accompany them while using it.

Whether they will feel secure enough. Whether they would use all the functionalities or quickly return to the web version (which they always had as an alternative), or whether they would use Open Banking at all (which we defined as a very risky feature - fear of granting someone access to one's account is one thing, a solution relatively unknown to society is another).

But how do we make people like the application that they’re forced to use?

It was meant to be a mandatory thing if you would want to use the services of the Debt Advisors and Insolvency Practitioners firms who help and represent you during your repayment journey. How to prepare the flow for the app that is directly connotated with the situation which is your biggest struggle? It wasn’t as easy as the budget tracing, nearly lifestyle, applications.

Another thing was that a lot of them would be using the app nearly once/a few times a year - the flow needed to be easy to use and understandable, while still giving info about the overall situation.

Throughout the whole project, we had those questions at the back of our heads - they were like the north stars that made us not lose our empathy and think about not just business but also those who would use Cerebreon products at the end of the day. Even if the Debt Advisors and Insolvency Practitioners were those who pay, Consumers (those in the money trouble) were the end users we needed to not forget about.

“Purple Deer’s dedication and ability to understand our industry and our end users profile was great. I’d happily go through the same process all over again!”

~Kenneth

🔎 What other risks we needed to overcome?

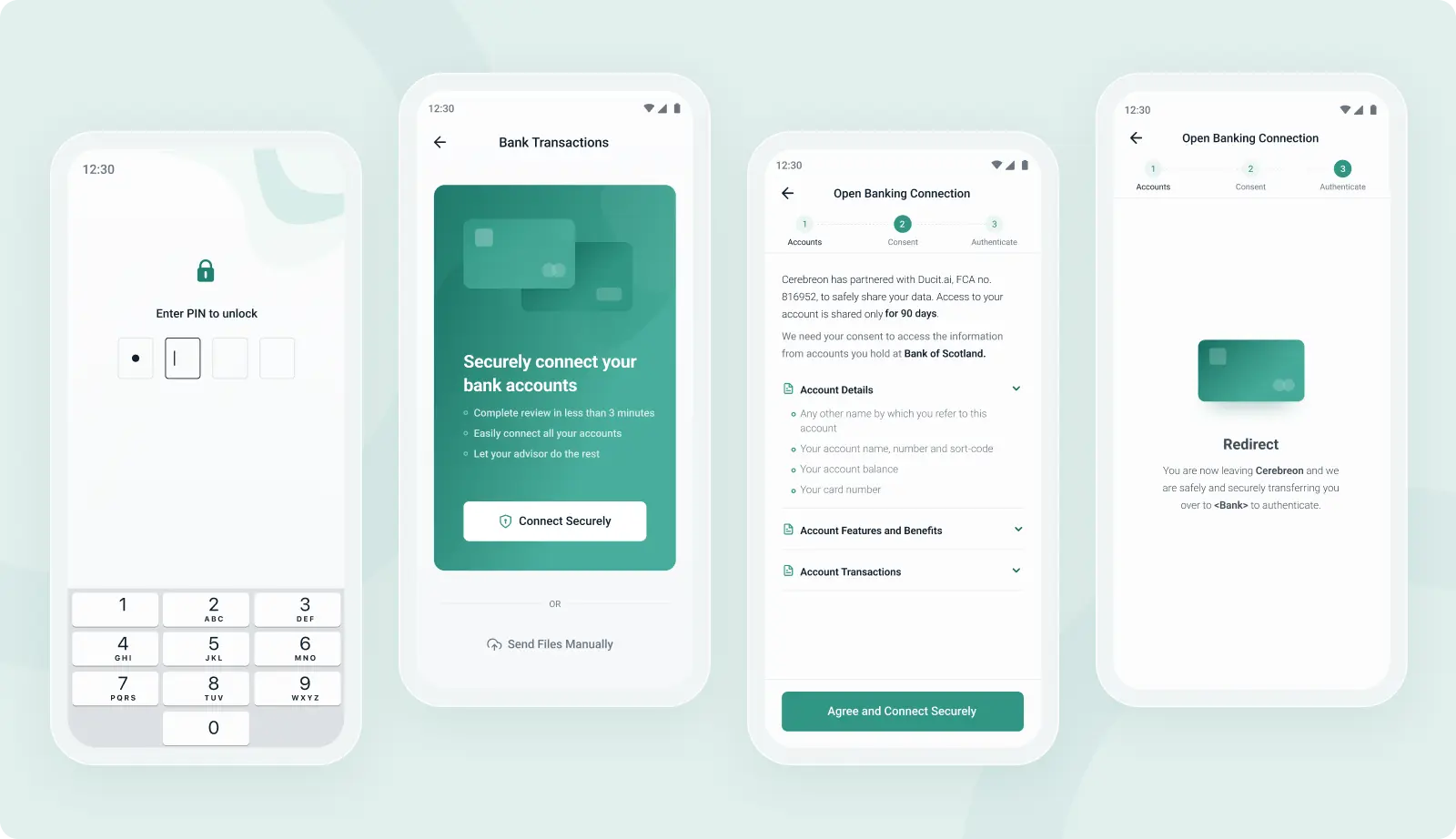

Integrating the flow with an external system/vendor, such as open banking, presented a unique challenge. This system lacked a user-friendly experience, making it crucial for us to design a clear and intuitive path. We had to alert users before exiting and cover all possible states in case of a hiccup on the external side. Additionally, we offered an alternative route for those hesitant or unwilling to use open banking, allowing manual file uploads. This flexibility was key, considering open banking was not a mandatory feature.

Handling sensitive user data, especially access to bank account information, demanded exceptional attention to language, security, and reassurance. Our goal was to make users feel safe and confident that they weren't falling into a scam or risking more money. Among the cool features we implemented was an extra layer of security with app-lock codes and a neat trick with bank apps. When you minimize the app and view the open apps, you only see the logo, not the app screen, ensuring no accidental peeks into sensitive information.

🦌 Effect & Deliverables

What we’ve created along the way?

Strategic Workshops:

Multiple collaborative sessions. They were more than just meetings; they were dynamic sessions of collaboration with the Cerebreon team. Here, we refined strategies and honed our initial ideas, establishing a foundation for smooth, ongoing teamwork. Each gathering ensured our collective vision for the app was perfectly aligned and ready to thrive.

Streamlined Information Architecture:

The development of the app’s flow, information architecture, and research documentation was a comprehensive process. It catered to both our internal needs and knowledge-sharing with the client’s team. This documentation was instrumental in maintaining transparency and alignment between our teams throughout the project.

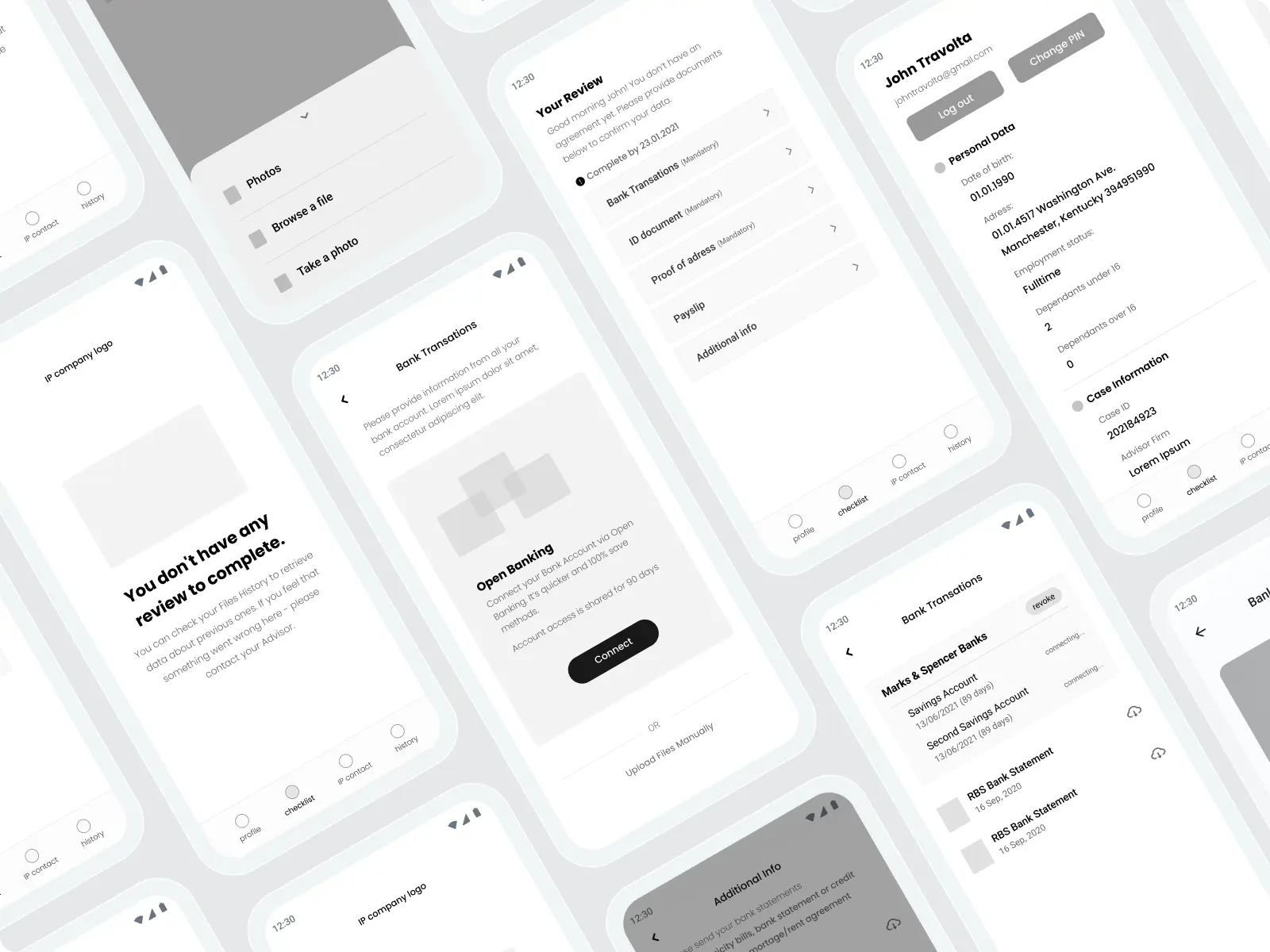

Intuitive Wireframes:

To visualize the concept and layout of the app, we created wireframes. These wireframes served as a crucial tool, not only for our internal team but also for presenting our vision to Cerebreon. They allowed everyone involved to better imagine and understand the structure and flow of the app before diving into the development phase. As always - the picture is worth more than a thousand words.

Interactive Prototype:

A no-code prototype was prepared to facilitate testing with Insolvency Practitioners. This step was pivotal in gathering real-world feedback and insights, ensuring that the app met the needs of both the practitioners and the end-users. It allowed us to iterate and refine the app based on practical, hands-on experience.

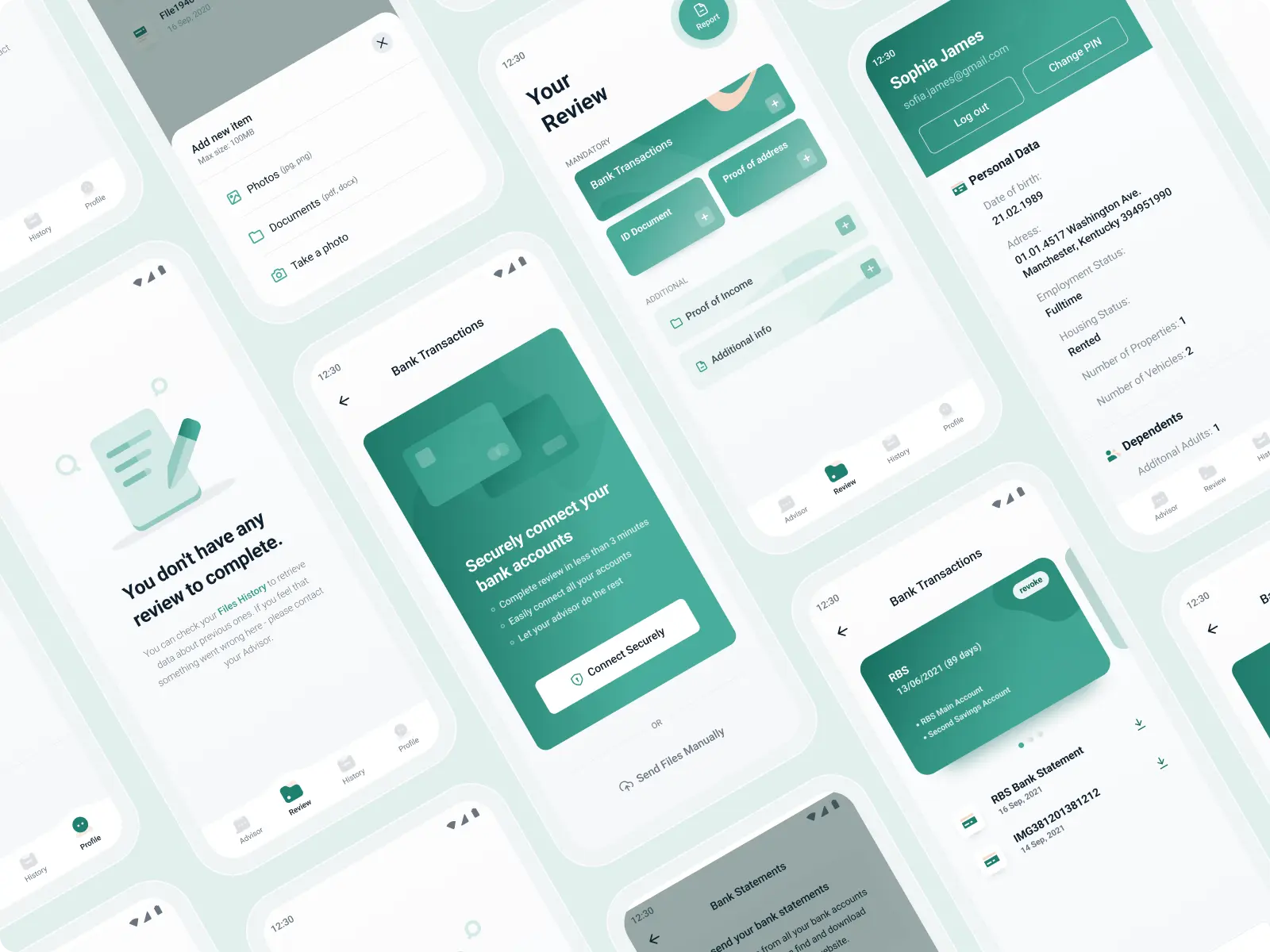

The whole application design:

Considering both mobile systems - iOS and Android - and their differences. The design of the application underwent two rounds: The first version was well-received by users and Cerebreon's direct clients, leading to Kenneth returning for additional features in a few months. Each time refining the user interface with an eye for detail and user engagement.

Proudly celebrated our first fully engaged user, who happens to be a remarkable 75-year-old!

Animated Badge System:

Engaging, motivational badges to boost user interaction.

Eye-Catching Store Graphics:

For the app's launch in digital storefronts, we crafted bespoke graphics. These visuals were not only eye-catching but also communicated the essence and functionality of the app, attracting potential users at first glance.

🔢 Numbers

2 mobile developers

2 developers from Cerebreon

2 people in the Deers UX & Business team

2 clients, Kenneth & Gillian, along with their Board members

75-years-old user who used the app successfully

3,5 months from the first workshop till the first app version launch

over 60 design screens

After the app release only ~20% of Annual Review clients actually signed in and shared data via the App/web- portal. 78% of these clients (i.e. 78% of 20%!) opted for the Mobile App over the Web- Portal

💥 Conclusion

As a team with Cerebreon, we had to find many answers to understand our end-users' needs and behaviours. After hours spent on business analysis, market research, and collecting information about our users, we’ve built a product that’s not only user-friendly but truly life-changing.

Joining forces with Cerebreon, we crafted a life-changing app, as proven by our delighted 75-year-old user. Are you ready to revolutionize your field? Reach out to us, and let’s embark on a journey to innovate and excel.